Denial of Shipment (DoS): Difficulties in tantalum raw materials transport, and potential solutions

5 May 2021

This paper was given by Ulric Schwela on behalf of the T.I.C. at the IAEA Technical Meeting on Denials of Shipment held online from March 23rd to 26th 2021. Mr Schwela was the T.I.C.’s Technical Officer2005-2016 and is currently the Managing Director of Salus Mineralis Ltd, a specialist NORM transport consultancy which regularly works with the T.I.C. on NORM issues (he can be contacted at us@salusmineralis.com). The T.I.C. invests a lot of effort working with regulators and other stakeholders on issues concerning Naturally Occurring Radioactive Materials (NORM) and Denial of Shipment.

This article was first published in the April 2021 edition of the Bulletin, the T.I.C.'s quarterly journal.

Executive Summary

Tantalum is a non-radioactive metal, present in rocks and ores that can be radioactive due to naturally occurring thorium and uranium. These raw materials require transport to facilities that have the specialist technology to extract the non-radioactive tantalum. Most transport is by land and sea in large freight containers, some by air, and materials above 10 Bq/g require transport as Class 7 Dangerous Goods. Maritime transport of Class 7 is no longer viable for most companies, due to fewer carriers accepting Class 7 for transport, and on fewer routes. The main reason for non-acceptance of Class 7 for transport is the financial risk to carriers of transporting a niche product that may see an entire container ship being delayed or rerouted due to a sudden refusal to accept it for transit or transhipment at a planned port of call, once the ship is already underway. Despite Class 7 being a premium product commanding a premium freight charge, the increased fee is far less than the financial cost of a delay or rerouting. Further, the transport of Class 7 (radioactive materials) suffers from an image problem, with the perception that these materials are somehow inherently more dangerous than other classes of dangerous goods (explosive, flammable, oxidising), whereas in fact the transport of radioactive materials has an excellent and enviable safety record.

A number of undesirable consequences have arisen as a result of these transport difficulties:

1) Almost every consignor of tantalum raw materials no longer even attempts to ship Class 7, and instead dilutes the radioactivity concentration to <10 Bq/g by blending with low grade materials, in order to be able to transport as general goods reliably.

2) A few consignors use air freight despite the greatly increased cost, the benefit being fast and reliable delivery.

3) A number of companies (that are not T.I.C. members), feel the necessity to consider shipping raw materials by sea as misdeclared cargo, in contravention of the transport regulations that govern road transport and international maritime transport, with the tacit acceptance of key stakeholders along the supply chain.

Nos. 1) and 2) represent less economical or sustainable transport solutions, with increased carbon footprint for the quantity of valuable metal transported. No. 3) is not only an offence, but also puts transport workers at potentially greater risk, and could damage other goods such as photosensitive material, if the carrier is not informed and can not take appropriate precautions. Also, no. 3) is an anti-competitive distortion of the market, as the receiving companies are able to obtain higher grade material at lower transport costs. The recommendations are i.a. that resources should be allocated on a permanent basis to maintain awareness of denial of shipment issues through effective communication and inclusion in training programmes, with a view to promoting harmonisation in the implementation of transport regulations in different states, and thus create a level regulatory and competitive playing field for the economic benefit of all.

The majority of tantalite shipments are made in ocean-going containers: (left) tantalite in drums, on pallets, loaded in freight container on a truck, and (right) an ocean-going container ship (photos: T.I.C. and Shutterstock)

Tantalum properties

Tantalum is a non-radioactive metal, which occurs in nature in rocks and ores that can be naturally radioactive due to thorium and uranium in the crystal lattice, and these ores require transport to facilities which have the specialist technology to extract the non-radioactive tantalum. Tantalum is a refractory metal with a particular range of properties including high dielectric potential in its oxide form, high refractive index in optics, exceptional resistance to acids as a metal, utility as a micro alloying element, great hardness in its carbide form, and excellent biocompatibility as an implant. A little over half of all tantalum is used in electronic applications, not only in electronic capacitors due to its dielectric potential being among the most volumetrically efficient in existence and with excellent uniform performance over a broad range of temperatures and under vibration, but also as a barrier layer between copper and silicon in semiconductors, and other technical applications in computer storage. It is the high-performance component of choice in demanding applications such as engine management units, borehole drill head sensors, heart pacemakers, and satellite electronics, where reliability is paramount. The full range of applications would make for a long list.

In optical applications it helps lenses for glasses/spectacles and mobile phone cameras be made thinner and lighter. It resists almost all acids and is the only metal to have corrosion resistance equivalent to glass, only being dissolved by hydrofluoric acid. For this reason, it is used for chemical process equipment that handles particularly aggressive environments, and provides a longer service life thus reducing down time. It is an essential microalloying element in a number of aerospace and turbine alloys, for jet engines and gas turbines, giving greater toughness and enabling higher operating temperatures, thus improving efficiency and service life. It also finds use as a carbide in cutting tools in e.g. the automotive industry. Last but by no means least, its biocompatibility and ability to achieve a stiffness equivalent to bone, means that implants do not suffer adverse immune response, and indeed bone implants become incorporated by new bone growth. The size of the tantalum market is equivalent to approximately 2'000 to 2'500 mt of Ta metal per year, which depending on the type and grade of material varies greatly in value. If taken as Ta metal, the total value would be of the order of $500M to $750M, although the overall value to society in terms of technology, functionality, efficiency, safety and medical uses, is inestimable. It is because tantalum is irreplaceable in so many critical technologies that it is often among those natural resources deemed “critical” or “strategic” by economists and politicians (USA, EU, Japan, Canada etc - see Bulletin #184 for details).

Occurrence and need for transport

Present in the earth’s crust at an average of 2 ppm (0.0002 %), tantalum deposits can be found all over the world, however they are generally at far too low concentrations to be economically viable, even considering the high value of tantalum metal. Some deposits have tantalum as a by-product or co-occurrence with other significant elements such as niobium, tin, tungsten, lithium or rare earths. The most important deposits in operation today are located chiefly in Australia, Brazil, DR Congo, Ethiopia, and Rwanda, as well as smaller or lower grade deposits in Bolivia, Burundi, China, Colombia, Mozambique, Nigeria, Russia and Sierra Leone (see below). According to the United States Geological Survey, there are >110’000 mt of tantalum reserves in the world, not including central Africa where most tantalum raw materials are currently extracted. Given the size of the tantalum market, there is sufficient tantalum in the world for at least 50 years, and there is more yet to be discovered. As such, tantalum raw materials are plentiful.

The tantalum minerals contain tantalum in its pentoxide form Ta2O5, and within the same crystal lattice are also naturally occurring thorium and uranium which occupy the same crystal lattice spaces interchangeably. It is these intrusions of Th and U, together with their daughter elements, which make tantalum minerals radioactive, or Naturally Occurring Radioactive Materials (NORM). The total parent radioactivity concentrations range from 5 to 50 Bq/g, in a few cases more than 100 Bq/g. In order to extract the tantalum from the minerals, the refractory nature means the mineral can not be separated by physical means at the mine site, and instead requires technically complex and hazardous digestion in hot hydrofluoric acid or equivalent processes, which can only be carried out at specialist processing plants. These processing facilities are almost all located in another country from where the mines are, therefore necessitating transport. In all cases except some moderate tonnages within Brazil, China and Russia, transport is international. The international destination countries include China, Estonia, Germany, India, Japan, Kazakhstan, Mexico, Russia, Thailand, United States.

World map showing the location of tantalum deposits and the processing facilities they need transport to (U. Schwela 2021).

At the processing facilities the tantalum and any other valuable non-radioactive elements are extracted, while all the radioactive elements are disposed of in residues or waste. The transport mode will generally be road and sea, however air transport is sometimes used when there is no sea route available. The availability of sea routes for Class 7 transport has been diminishing as the maritime carrier industry has been contracting, with shipping lines being bought up or joining into fewer and bigger groups, and generally adopting the most restrictive policies of the individual members. While air transport is quicker, simpler and more reliable, it has the drawbacks of often being more expensive than is economically viable, and having a much greater carbon footprint. The total gross quantity of tantalite raw materials transported annually is of the order of 10’000 mt (containing the 2'000 to 2'500 mt of Ta metal equivalent mentioned above), or a minimum of 500 freight containers each carrying 10-20 mt of material. Much of this would require transport as Class 7 radioactive material (in accordance with IAEA SSR-6, IMDG Code Class 7, and others as applicable), and where the radioactivity concentration is below 10 Bq/g the material would be exempt from transport regulations for radioactive materials and could be transported as general cargo.

Transport method

Tantalum raw materials are typically shipped by sea as a dry mineral (<0.5% moisture) with a grain size below 5 mm, typically packed in new steel drums with separate lids held in place by a steel band, or alternatively in recycled metal drums, plastic drums, or simply in new or recycled 1 mt bulk bags, or 50 kg plastic bags. The material may even be stowed unpackaged in a freight container, with the container acting as the packaging, with an interior liner to prevent material loss. If sent by air, the material will be packed in new steel drums with an inner liner, and each drum may then have a custom made crate built around it to prepare it for transport. Due to the density of tantalite, a 20 mt shipment of tantalite will not fill the entire volume of a freight container. Sometimes smaller shipments of 10 or 15 mt are made.

Denial and delay examples

For a delay or denial of shipment to exist, the material to be shipped would meet all applicable transport requirements for radioactive materials. Despite Class 7 being a premium product commanding a premium freight charge, the increased fee is far less than the financial cost of a delay or rerouting. Further, the transport of Class 7 (radioactive materials) suffers from a problem with its image, the perception often being that these materials are somehow inherently more dangerous than other classes of dangerous goods (explosive, flammable, oxidising), whereas in fact the transport of radioactive materials has an excellent and enviable safety record. From recent enquiries across the entire tantalum industry, the ability to transport Class 7 has not improved, and is now clearly more difficult than when the T.I.C. first began fact finding on this issue in 2004. The identity of respondents has been kept confidential, however the types of delays and denials are discussed below. The difficulties arise principally in obtaining carriage.

Obtaining carriage

When a company attempts to obtain carriage for tantalum raw materials above 10 Bq/g, the response from maritime carriers falls into one of the following categories: no response; blanket refusal; non-recognition of excepted package; exorbitant quote for carriage with no guarantee of delivery. All of these responses are valid and permissible commercial decisions, and we need to look deeper to find their root cause.

- No response

The carrier simply does not reply to enquiries requesting quotes for carriage of tantalum raw materials.

- Blanket refusal

The carrier refuses to accept any tantalum raw materials, regardless of their radioactivity concentration.

- Non-recognition

The carrier does not recognise the status of exempted (<10 Bq/g), or UN 2910 (Excepted Packages), where applicable, and insists all tantalum raw materials must be declared as UN 2912 (Low Specific Activity I). This particular issue began occurring around 2017 and has become entrenched with a number of carriers.

- High fees, no guarantees

The carrier will quote a fee typically 5-10 times greater than the normal rate. Despite this, no guarantee of delivery is provided, as the carrier will reserve the right to offload the Class 7 container at any port along its route should it choose to do so, and the consignor would then have to attempt to rearrange onward transport as a new booking. With some carriers, their response is systematic and will de facto not accept Class 7. A few carriers will accept Class 7 tantalum raw materials if their end destination is the carrier’s home country, or shepherded by a trusted logistics brokerage. Geographically, the difficulties arise most often on routes from eastern Africa to Europe or the USA, for example in one instance when the Suez Canal denied passage to a container with Class 7, it necessitated a maritime journey of 12300 nautical miles via South-East Asia followed by a road journey of over 4300 km, instead of the more direct route of 8400 nautical miles via the Suez Canal, plus a mere 100 km by road to reach its destination. Similar examples exist elsewhere, and are due to not being able to obtain carriage by the most efficient and cost-effective route. As a trend, the situation has been worsening and it is harder than ever to transport tantalum raw materials, for all the reasons listed above.

- Carrier justification

Why do carriers respond in this manner? There are several reasons, one of which is increased risk to their business. For example a vessel carrying as little as one container of Class 7, may unexpectedly be advised by the next port that it will not be allowed entry due to the container of Class 7, thus requiring a rerouting that may incur additional costs in excess of $500k, that may be as much as 10 or 20 times or more the shipping rate charged for that one container, due to the need to offload and reroute a great number of containers, plus potential penalties for late delivery.

- Root cause

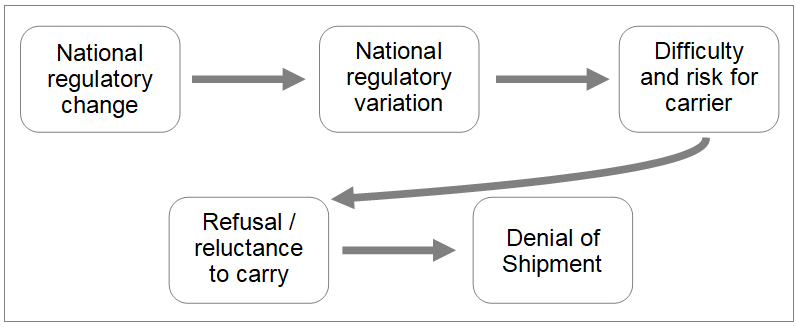

The difficulty for carriers arises from ports and local authorities, or national regulations that are incompatible with those of another jurisdiction along that transport route, or due to sudden decisions taken once the ship is already en route. States have the sovereign right to set regulations as appropriate and necessary for their particular jurisdiction. What there needs to be however is greater awareness of the impact of having regulations that differ or vary from international regulations. There needs to be co-operative communication between authorities at all levels for there to be better awareness of the impact of regulations, and coordination to minimise duplicative, overlapping and sometimes contradictory requirements. There needs to be consistent application of regulations, with any changes being applied after a transition period in order to enable carriers and industry to adjust and adapt, and not with immediate effect, potentially causing great disruption, cost, and increased risk to the safety and security of Class 7 shipments already on the high seas.

How regulatory variations can be root causes of denial of shipment (U. Schwela 2021)

Recent developments

On a few routes, it is still possible to transport tantalum raw materials as Class 7, particularly with national carriers to their key domestic market. In this context the continued support for Class 7 exists with close communication between the receiving processing facility, the national and/or local authorities, and the national maritime carrier. However as a result of the increasing difficulty or complete impossibility in obtaining carriage for Class 7 on a number of key routes, in recent years there are three major developments that have taken place:

1) Whereas most tantalum raw materials have Th+U radioactivity concentrations in the 5-50 Bq/g range, it has become almost ubiquitous to either:

a) Blend high and low grades of minerals down to below 10 Bq/g in order to be able to transport as general cargo, with a loss of efficiency and payable content and higher carbon footprint;

b) Blend valuable mineral with worthless sand or gravel down to below 10 Bq/g in order to be able to transport as general cargo (as is perfectly permissible if uniformly blended), with a loss of efficiency and payable content and higher carbon footprint;

2) Transport smaller tonnages as Class 7 by air freight. Class 7 transport by air freight is less subject to unexpected denials en route and therefore presents less financial risk, is of course much quicker, but at greatly increased cost and carbon footprint, partially offset by the opportunity to send tantalum raw materials with as high a valuable concentration as possible, and radioactivity concentrations that may exceed 50 Bq/g;

3) UN 2910 (Excepted Package) is often not recognised or accepted, and carriers will insist on UN 2912 despite a package conforming to UN 2910. Excepted Packages could fulfil a very useful role as an intermediate level of regulation, however this is difficult to achieve for large freight containers and is hampered by a lack of recognition.

While the above developments are examples of how stakeholders will find ways to adapt to regulations, it is unfortunate in that these represent less efficient ways of obtaining transport.

Unintended consequences

- Finding alternative ways to transport

The current difficulty in obtaining transport can lead to unintended consequences. It is understood that certain stakeholders (outside of the T.I.C. membership) feel that they no longer have a legitimate outlet for their mineral export and would need to close their mines, lay off hundreds of workers, thereby impacting the thousands of people who depend on that economic activity for their livelihood. Faced with this situation, and possibly with the acceptance or even support of their national authorities that would rather see the economic activity continue, these stakeholders could find creative ways to circumvent the international regulations and avoid declaring material above 10 Bq/g as Class 7, something that in turn would be accepted by the consignee and the authorities at destinat ion in order to protect that supply route. They could be seen as bilateral or multilateral agreements as allowed for in regulations, however these would be informal arrangements outside of the transport regulations. It could potentially impact the safety of workers along the supply route. If the existing framework of transport regulations that apply to minerals unintentionally happens to stifle transport and trade, to the point where certain national authorities would unofficially allow materials to be exported or imported without being declared as radioactive material, it surely would put into question whether the framework was fulfilling its intended purpose of ensuring safe and secure transport of all radioactive materials. For the avoidance of doubt, let it be clear that no T.I.C. member is known to ship material >10 Bq/g without declaring it, and that such activity would be in clear breach of the T.I.C. Transport Policy as well as being a serious offence against the transport regulations and any applicable national regulations.

- Reassessing the implementation of transport regulations

What is really important is to understand that while the transport regulations present a framework that is technically sound and has been developed over more than 60 years and with an enviably excellent safety record, they are however not being implemented uniformly. This is known and accepted and allowed for as a sovereign right.

The variability in regulations this creates, leads to an environment of uncertainty and great financial risk to the carriers, consignors and consignees concerned. This risk is leading to fewer and fewer carriers that will accept to carry Class 7 material, particularly so as the maritime carrier industry has been coalescing and consolidating into fewer and bigger groups with a consequent streamlining of their policies, a streamlining that has tended to oust some working practices such as the acceptance of Class 7.

This is contributing to a situation where hundreds of mine workers and thousands of their dependents are threatened with a loss of livelihood, and this risks pushing people into non-compliance.

- Winners and losers

If every destination country followed the transport regulations, there would be no opportunity to misdeclare Class 7 cargo, there would be nowhere to send it, as it would simply be returned to origin. However all it takes is for one major country to allow for undeclared material >10 Bq/g to arrive at its ports and move smoothly on to the consignee, and suddenly there is an outlet. Material >10 Bq/g has a route to market under the radar, and this distorts the market in favour of the recipient country as it can receive high grade material at general cargo rates. The rest of the world labours with the restriction of having to blend down and transport low grade material, or taking a great risk in attempting to transport Class 7 correctly. We need to ask ourselves what the solution to this is, whether it is a bigger stick to beat the poor miners with (particularly as these are primarily in developing countries that already have limited employment opportunities), naming and shaming the recipient country accepting misdeclared cargo, or a thorough reassessment of how uniformly the transport regulations are applied so that companies may confidently ship Class 7 material again, and carriers will willingly transport it.

Potential solutions

During the existence of the International Steering Committee on Denial Of Shipment (ISC-DOS) from 2006 to 2013, an action plan existed that was based around six key areas: awareness, communication, economic, harmonisation, lobbying and training.

- Awareness will always be needed, as staff changes and competing priorities at every point along a supply chain necessitate reminders of the denial of shipment issue, its impact, and the importance of keeping radioactive materials moving in a safe, secure and sustainable manner.

- Communication is the means with which we achieve Awareness, as well as all the other points of the action plan. The ISC-DOS prepared a detailed and excellent communication strategy that would still be valid today in showing how best to communicate with which target audiences.

- Economic is the argument for sustainability, for a low carbon footprint, for maintaining the economic activities without which there would be nothing to regulate.

- Harmonisation* is often understood in the IAEA transport community within the narrow meaning of reconciling IAEA regulations with those of other UN organisations. Harmonisation has to mean much more than this, it has to mean the encouragement of national, regional and local authorities to reconsider the regulatory variations that exist, to facilitate the discussion between authorities at different levels, within regions and between regions, to really understand the impact of such variations, and cooperate on mutually beneficial solutions.

- Lobbying is simply an element that binds the others together, it is the raising of awareness, the initiation of communication, the arguing for the economic impact, for harmonisation, and for training.

- Training, like awareness, will always be needed. New staff need starter training, other staff need continuous professional development and refresher training. Training is the step by which simple awareness is turned into real technical knowhow and a deeper understanding.

All six of these areas still have a relevance today, with awareness and training being top priorities, communication and lobbying being two means to achieve this, and harmonisation and a positive economic impact being ideal goals to attain.

* As reported in Bulletin #180, #182 and #184, currently the T.I.C. is part of the NORM Exemption Group within TRANSSC (the IAEA’s committee responsible for reviewing and revising the regulations for the transport of radioactive material) at the International Atomic Energy Agency (IAEA). This group is charged with examining the regulations that apply to the transport of NORM. The work of this group centres on examining the differences in the exemption provisions between the ‘new Basic Safety Standards’ (General Safety Requirements Part 3 (GSR Part 3)) and the transport regulations (Safety Standards Series 6 (SSR-6)). [GSR Part 3 is one of the core IAEA regulations which other IAEA regulations should be consistent with]. The group is also checking for inconsistencies in the guidance that comes with the transport regulations (SSG-26) too. The transport regulations are unique and written in a different way to the new Basic Safety Standards because they deal with a particular activity that has specific requirements. Over time this has resulted in several inconsistencies appearing between the two sets of regulations, for example there is a particular clause in GSR Part 3 relevant to NORM which is not applied to transport of radioactive material in bulk, but most experts agree probably should apply. This is a rare opportunity to reconsider how best to regulate global NORM transport and the T.I.C. will endeavour to keep members and stakeholders informed of opportunities to provide their support so that the IAEA’s working group can reach the best possible decision. Further information is available on the T.I.C. website www.tanb.org.